Debt consolidation is a term often heard in financial conversations. It refers to a financial strategy where individuals combine their debts into a single monthly payment to make it more manageable. In Canada, consolidating debt is a popular option for people struggling to pay off multiple loans or credit card balances. This blog post aims to provide a comprehensive understanding of how to consolidate debt in Canada and why it can be beneficial.

Debt consolidation is a term often heard in financial conversations. It refers to a financial strategy where individuals combine their debts into a single monthly payment to make it more manageable. In Canada, consolidating debt is a popular option for people struggling to pay off multiple loans or credit card balances. This blog post aims to provide a comprehensive understanding of how to consolidate debt in Canada and why it can be beneficial.

What is Debt Consolidation?

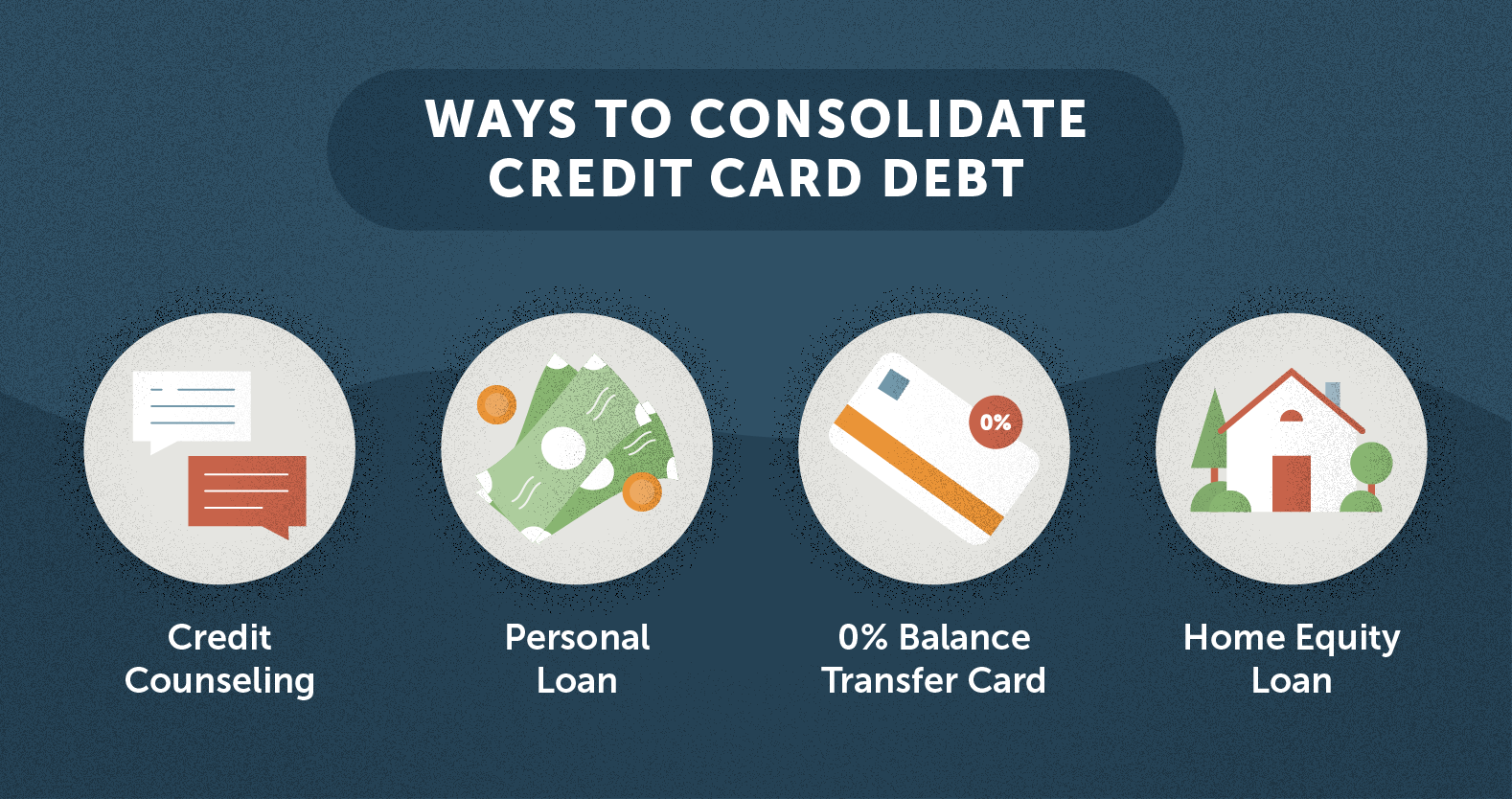

Debt consolidation involves taking out a new loan to pay off various existing debts simultaneously. By doing so, individuals can streamline multiple payments into one, usually at a lower interest rate. This allows borrowers to simplify their finances and potentially save money by reducing interest charges.

How Does Debt Consolidation Work?

To consolidate debt in Canada, one needs to qualify for a debt consolidation loan. Eligibility typically depends on factors such as credit score, income, and overall debt level. Once approved, individuals can use the loan amount to pay off their existing debts, leaving only a single monthly payment towards the new loan.

Benefits of Debt Consolidation:

Simplified Finances:

Consolidating debt merges multiple payments into one, making it easier to keep track of finances and stay organized.

Lower Interest Rates:

Debt consolidation loans often come with lower interest rates compared to credit cards or other high-interest debts, potentially saving borrowers money.

Debt Repayment Plan:

It allows individuals to create a structured repayment plan that aligns with their financial goals and helps them become debt-free sooner.

Improved Credit Score:

Consistently paying off debt through consolidation can positively impact one’s credit score.

Considerations before Consolidating Debt:

Loan Fees:

Debt consolidation usually involves certain fees, such as origination or balance transfer fees. Carefully evaluating these expenses is crucial to ensure the overall savings outweigh the costs.

Closing Credit Accounts:

Consolidating debt often requires closing credit card accounts, which can impact the individual’s credit utilization ratio in the short term.

Lifestyle Changes:

While consolidating debt may help manage payments, it is essential to address the root cause of the debts. Without modifying spending habits, individuals may find themselves incurring new debts despite consolidation.

Impact on Credit Score:

Debt consolidation may temporarily impact the credit score. However, responsible debt management and on-time payments can help rebuild creditworthiness over time.

Debt consolidation in Canada offers individuals a practical solution to manage multiple debts more effectively. By consolidating debts into a single loan, borrowers can enjoy several benefits such as simplified finances, lower interest rates, and the potential to improve their credit score. However, it is important to consider factors like loan fees, closing credit accounts, and making necessary lifestyle changes to ensure long-term success. Ultimately, debt consolidation can serve as a valuable tool in achieving financial stability and becoming debt-free.