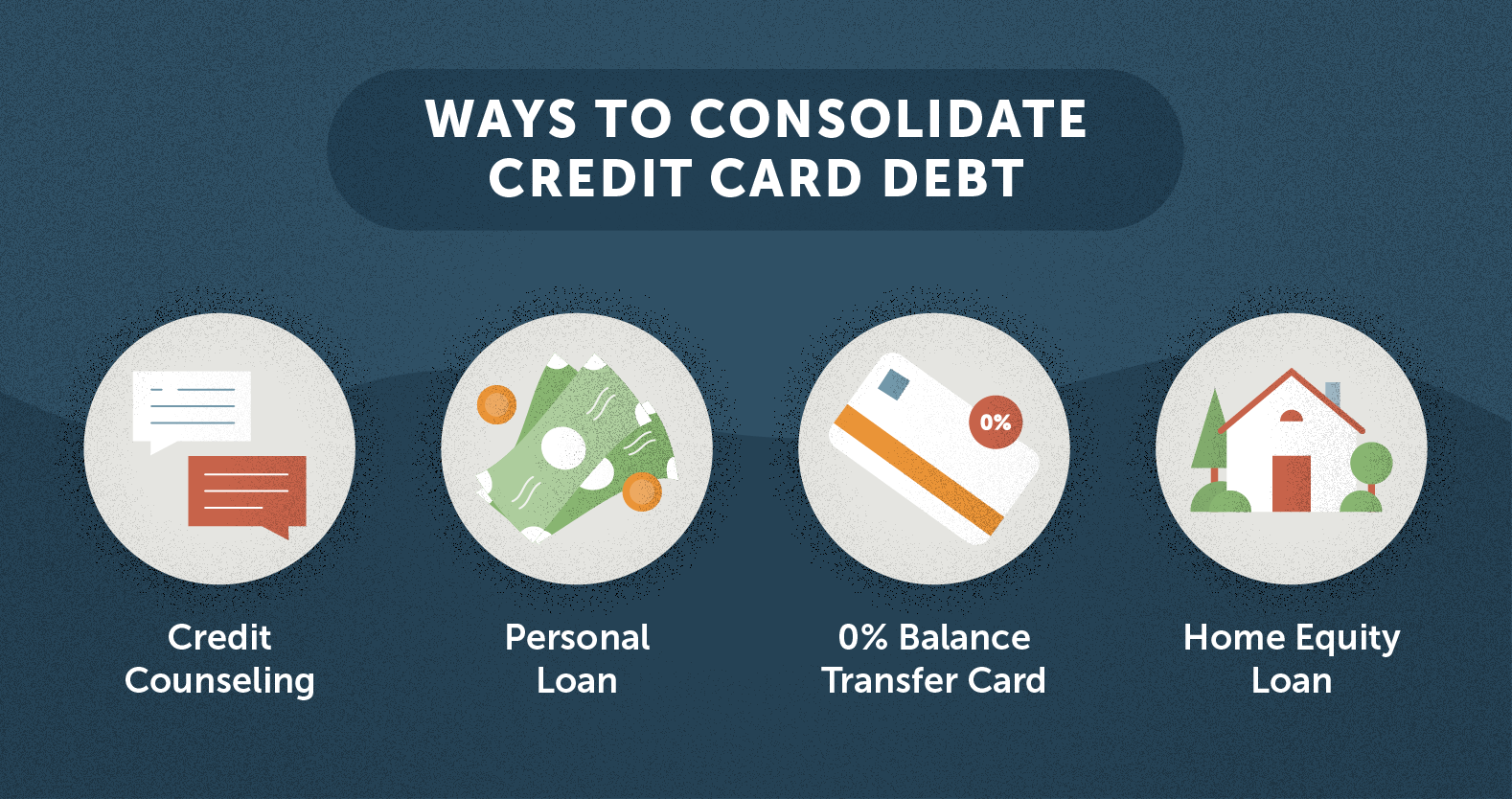

Debt can be overwhelming, but finding the right debt consolidation programs can help you regain control of your finances. If you’re in Alberta and considering debt consolidation, this comprehensive checklist will guide you through the essential factors to consider. Making an informed decision is crucial to ensure that the program you choose aligns with your financial goals and circumstances.…

Debt can be overwhelming, but finding the right debt consolidation programs can help you regain control of your finances. If you’re in Alberta and considering debt consolidation, this comprehensive checklist will guide you through the essential factors to consider. Making an informed decision is crucial to ensure that the program you choose aligns with your financial goals and circumstances.…